Captives take control: rethinking property insurance

Captives are reshaping property insurance as more companies are turning to captives to manage risk, speed up claims, and take control in an increasingly volatile insurance market.

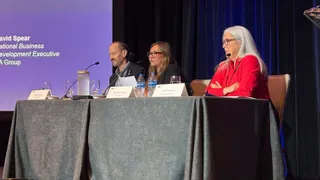

That was the message from a panel discussion at the Cayman Captive Forum 2025 on “Property Insurance and your Captive,” featuring Liz Fragoso, vice president of Risk Finance at Grace Indemnity Company SPC, Baoling Wang, senior vice president at Crawford GTS, and David Spear, national business development executive at YA Group. The session explored the evolving role of captives in property insurance and the strategic benefits of leveraging captive structures to manage risk.

Spear opened the discussion by tracing the historical origins of captives, noting that they were born out of necessity. Early captives were created by cargo shipping companies and healthcare institutions struggling to secure insurance for high-risk exposures. He highlighted the hardening property insurance market, driven by increasing natural disasters, and emphasised that captives are experiencing a resurgence as companies seek alternatives to traditional insurance. Captives, he explained, offer flexibility in policy design, coverage terms, and risk management, allowing organisations to better predict and control losses.

Spear detailed several advantages of captives for property programmes. Insurers increasingly impose higher deductibles and limit coverage, but captives enable companies to set their own retention levels and tailor coverage to their specific needs. Captives also provide potential financial benefits, as premiums remain within the parent company if losses are low, allowing dividends or reinvestment in the programme. Furthermore, captives facilitate faster claims payments, which is crucial for maintaining operational continuity after a loss.

The panel addressed different captive structures, including group captives, rented captives, and protected cell companies, and discussed the types of coverages suitable for inclusion. These range from standard building and contents insurance to business interruption, ordinance of law coverage, flood, equipment breakdown, and even warranty programmes. Fragoso highlighted her organisation’s experience with a deductible buyback policy for property, enabling the captive to reimburse losses within retention levels, and underscored the importance of in-house expertise to manage claims effectively.

Key considerations when implementing property programmes in captives include underwriting fundamentals, accurate valuations, and risk management. Spear emphasised the need for precise statements of value, appropriate replacement cost assessments—including demolition and debris removal—and robust disaster response planning. Establishing relationships with contractors, adjusters, forensic experts, and other service providers before a loss occurs is critical to ensure efficient recovery and cost management.

Wang contrasted traditional insurance with captives, noting that captive adjusters work directly for the captive owner, allowing for customised processes, faster claim payments, and alignment with organisational goals. She stressed that captives offer greater transparency in costs and retain more control over claims handling.

Fragoso shared her practical experience managing a large healthcare system in Dallas-Fort Worth. She explained how the captive structure allowed her to consolidate liabilities, optimise deductible levels, and strategically retain property risks, while ensuring her management team had visibility and control. She highlighted the importance of actuarial analysis, executive support, and comprehensive risk mitigation measures when considering property in a captive.

Spear concluded by emphasising transitional considerations, including board involvement, broker partnerships, and fronting carrier requirements. Early establishment of key relationships with subject matter experts, service providers, and internal personnel is vital to successful captive implementation and claims management.

The panel’s insights underscored that property insurance in captives offers flexibility, financial efficiency, and strategic risk management, making it an increasingly valuable tool in a hardening insurance market.

Did you get value from this story? Sign up to our free daily newsletters and get stories like this sent straight to your inbox.